The Inflation Reduction Act introduced the Section 45X Advanced Manufacturing Production Credit to boost domestic clean energy manufacturing. This powerful incentive can help businesses reduce costs and increase competitiveness in the growing renewable energy market.

The 45X credit provides a production-based tax incentive for manufacturers that produce eligible clean energy components in the United States. These include solar modules, wind energy components, battery cells and modules, inverters, electrode active materials, and critical minerals.

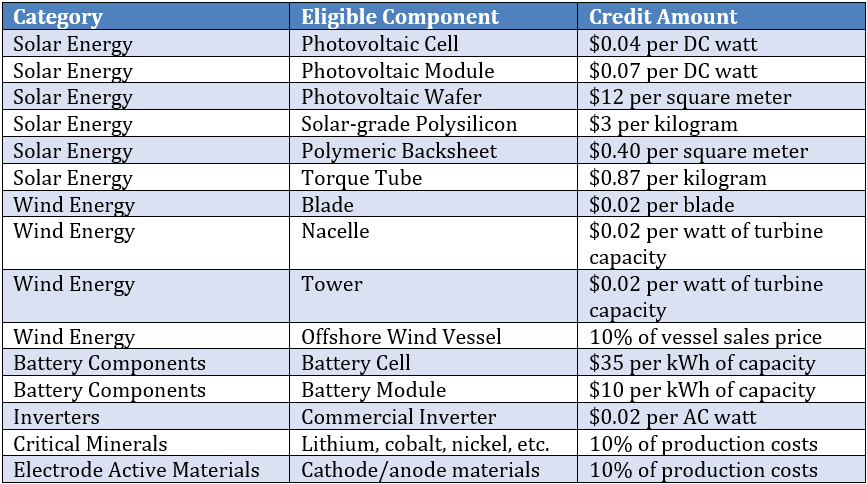

Businesses that manufacture any of the following components can take advantage of the 45X credit:

The credit is available for eligible production through 2032, but planning ahead ensures you capture maximum benefits. With options for direct payment and transferability, even businesses with limited tax liability can monetize these credits.

Porte Brown is here to help you navigate the complexities of the 45X credit and identify opportunities for your business. Contact us today to learn how you can maximize your savings and stay ahead in the clean energy revolution.

Get in touch today and find out how we can help you meet your objectives.